BukaLapak Insights

Stay updated with the latest trends and insights in e-commerce.

On-Chain Transaction Analysis: The Invisible Thread Connecting Blockchain Activities

Dive into the hidden world of on-chain transaction analysis and discover how it connects all blockchain activities! Uncover the secrets today!

Understanding On-Chain Transaction Analysis: How It Illuminates Blockchain Activities

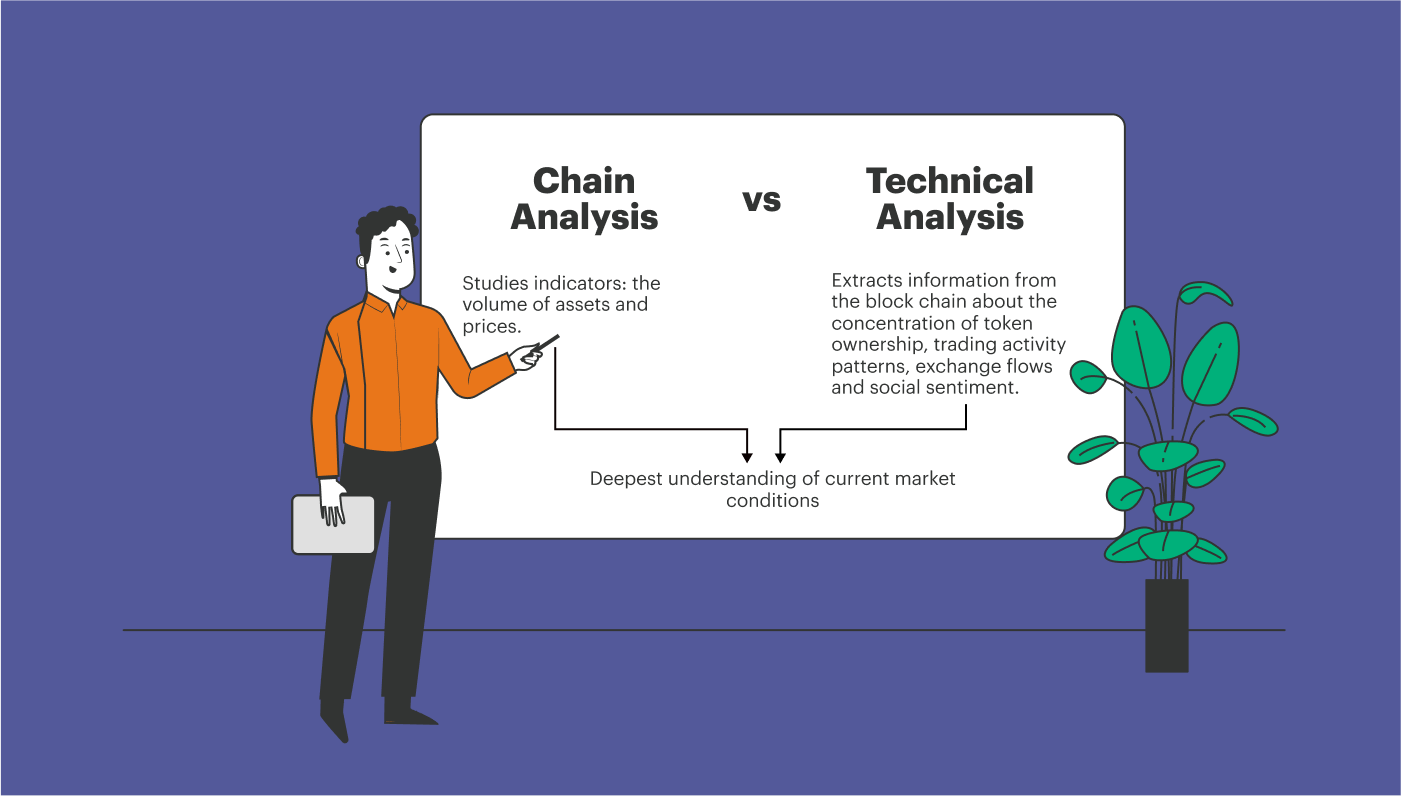

On-chain transaction analysis is a critical methodology that provides insights into the activities occurring within a blockchain. By examining the data recorded on the blockchain, analysts can trace the flow of transactions, identify user behaviors, and understand the underlying patterns that emerge from these activities. This type of analysis is invaluable for various stakeholders, including investors, regulators, and developers, as it helps uncover trends, detect anomalies, and assess the overall health of a blockchain network.

Utilizing advanced analytics tools, on-chain transaction analysis enables researchers to visualize transaction paths through graphs and charts, which can reveal significant insights such as transaction volumes and the movement of assets between wallets. By illuminating these activities, on-chain analysis not only enhances transparency but also aids in identifying illicit activities, ensuring better compliance with regulations. As the blockchain ecosystem continues to evolve, the role of on-chain transaction analysis will become increasingly vital in fostering trust and reliability within the space.

Counter-Strike is a highly popular tactical first-person shooter game that has captivated millions of players worldwide. With its competitive gameplay and team-based strategies, players engage in thrilling matches while aiming to achieve various objectives. For those looking to enhance their gaming experience, using a bc.game promo code can offer exciting benefits and rewards.

The Role of On-Chain Data in Uncovering Hidden Patterns in Blockchain

In the rapidly evolving world of blockchain technology, on-chain data has become a crucial resource for identifying hidden patterns that can inform decision-making and investment strategies. By examining the information recorded directly on the blockchain, such as transaction histories, wallet interactions, and smart contract activity, analysts and researchers can gain insights into market behavior that are not apparent through traditional analysis methods. For instance, the examination of on-chain data can reveal trends like increased activity around specific tokens or networks, suggesting potential growth opportunities or indicating underlying community sentiment.

Furthermore, leveraging on-chain data can enhance the effectiveness of predictive models in the blockchain ecosystem. By utilizing techniques such as data mining and machine learning, analysts can uncover correlations and trends that exist within the blockchain data. This capability allows for a more sophisticated understanding of user behavior and network dynamics, leading to improved risk assessment and strategic planning. As the technology matures, the depth of insights provided by on-chain data is likely to play an even more significant role in shaping the future of blockchain applications and investments.

What Can On-Chain Transaction Analysis Reveal About Cryptocurrency Trends?

On-chain transaction analysis is a powerful tool that allows investors and analysts to gain insights into the dynamics of cryptocurrency markets. By examining transaction patterns, wallet activity, and the flow of assets across the blockchain, one can uncover prevalent trends and anomalies that may not be immediately obvious through traditional market analysis. For instance, identifying spikes in transaction volume can indicate bullish or bearish trends, suggesting potential price movements and helping traders make informed decisions.

Moreover, on-chain data enables the assessment of investor sentiment and network health. Metrics such as the number of active addresses, average transaction size, and transaction fees can provide insights into the overall adoption and usage of a cryptocurrency. An increasing number of active addresses often signals growing interest and engagement, while high transaction fees may indicate network congestion, which can impact user experience. As such, on-chain analysis facilitates a deeper understanding of cryptocurrency trends, ultimately enhancing strategic investment approaches.