BukaLapak Insights

Stay updated with the latest trends and insights in e-commerce.

Insurance Quotes: The Hidden Gems You Didn't Know About

Discover unexpected insurance quotes that could save you money! Unlock the hidden gems of coverage and get the best deals today!

Uncovering Insurance Quotes: What Deceptive Discounts Might Cost You

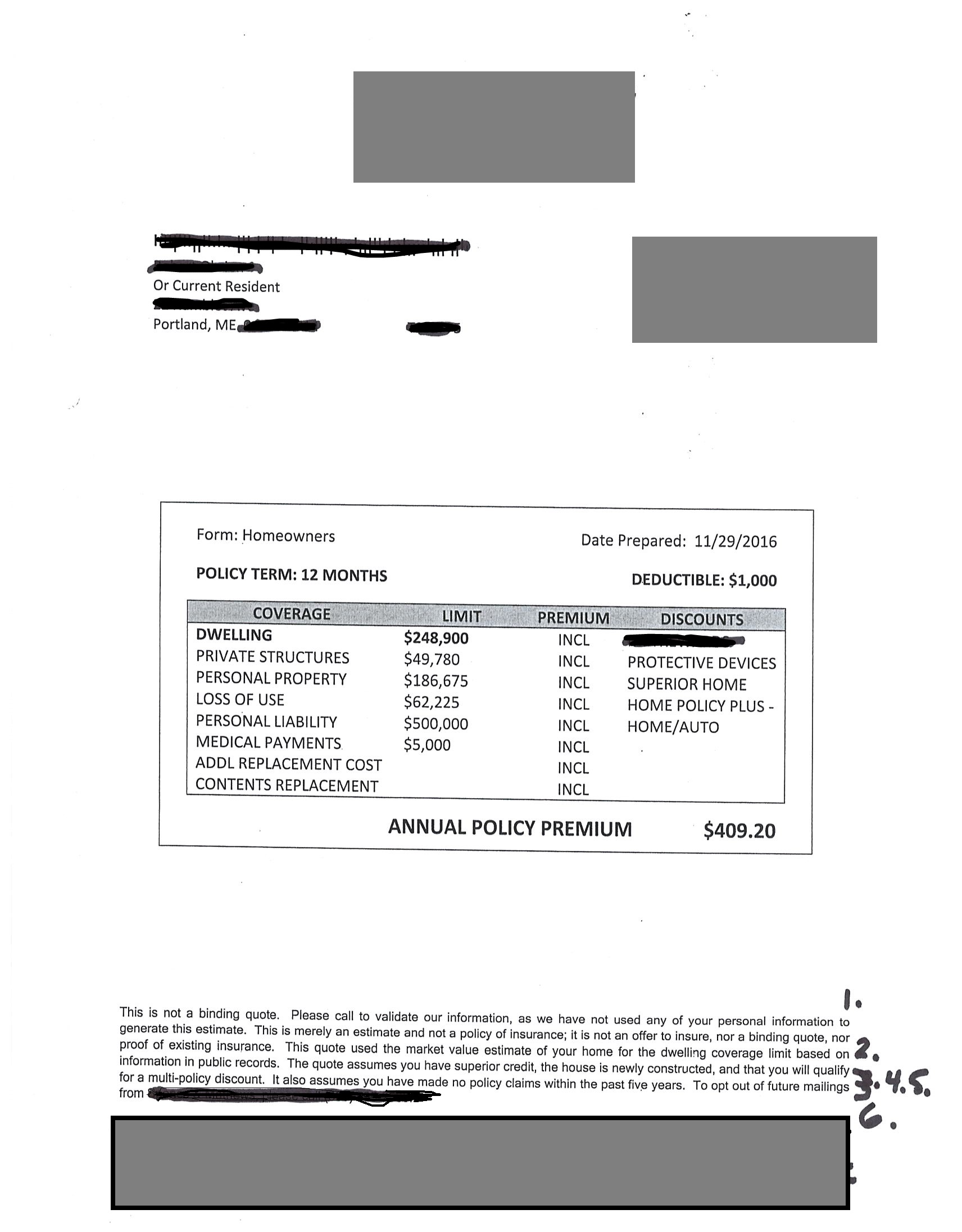

When searching for insurance quotes, many consumers are tempted by enticing discounts that promise significant savings. However, it's crucial to approach these offers with caution, as they often come with hidden costs. For instance, a company might advertise a low premium, only to include high deductibles or limited coverage options. This can lead to expensive out-of-pocket expenses in the event of a claim, ultimately negating any savings you initially thought you were making. Always take the time to read the fine print and understand what you're actually signing up for.

Moreover, some insurers might use deceptive practices by bundling policies with discounts that seem appealing but can result in inadequate coverage. Consider the following factors when evaluating insurance quotes:

- Coverage Limits: Review what is included and ensure it meets your needs.

- Exclusions: Be aware of any exclusions that might leave you vulnerable.

- Claims History: A low premium could indicate a history of high claim denials.

By staying informed and scrutinizing each quote, you can avoid traps that might cost you significantly in the long run.

The Secret Factors Influencing Your Insurance Quotes: What You Need to Know

When it comes to understanding insurance quotes, many consumers underestimate the complex factors that influence the pricing of their policies. One of the primary elements is your credit score, which can impact your premiums significantly. Insurers often use credit reports to gauge the likelihood of a policyholder filing a claim. Additionally, your driving history plays a crucial role; a record of accidents or traffic violations can lead to higher rates. Demographic factors, such as age, gender, and marital status, also contribute to how insurers assess risk and determine quotes. For instance, younger drivers typically pay more due to a lack of experience on the road.

Another essential aspect to consider is the coverage limits you choose. Opting for higher coverage will naturally lead to higher premiums, so it’s vital to find a balance that suits your needs and budget. Moreover, location significantly affects your insurance quotes. Areas prone to natural disasters or high crime rates may see increased rates due to the higher risk involved. Lastly, the type of vehicle you own can also affect your rates; cars with high safety ratings and lower theft rates usually come with better insurance quotes. Understanding these factors can empower you to make informed decisions and potentially lower your insurance costs.

Are You Missing Out? 5 Hidden Gems in Insurance Quotes That Save You Money

When it comes to finding the best insurance quotes, many people overlook some valuable hidden gems that can lead to significant savings. One of the first aspects to consider is the deductible options. Often, choosing a higher deductible can lower your premium substantially. This is especially beneficial if you have a good driving record or a healthy lifestyle, as it can reduce the likelihood of filing a claim. Additionally, many insurers offer discounts for bundling policies, so don't hesitate to ask if you can combine your auto and home insurance to snag lower rates.

Another key factor in your search for the best insurance quotes is the usage-based insurance models, which have become increasingly popular. These programs use telematics to track your driving behavior and reward safe drivers with lower premiums. Furthermore, you may be missing out on loyalty discounts that some companies offer for long-standing customers. Don't forget to inquire about affiliation discounts as well; if you're part of certain professional organizations, alumni groups, or even military services, you could unlock additional savings on your insurance premium.